Agriculture Tax Exempt Form Kentucky . The kentucky department of revenue. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under.

from www.exemptform.com

Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. The kentucky department of revenue. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax.

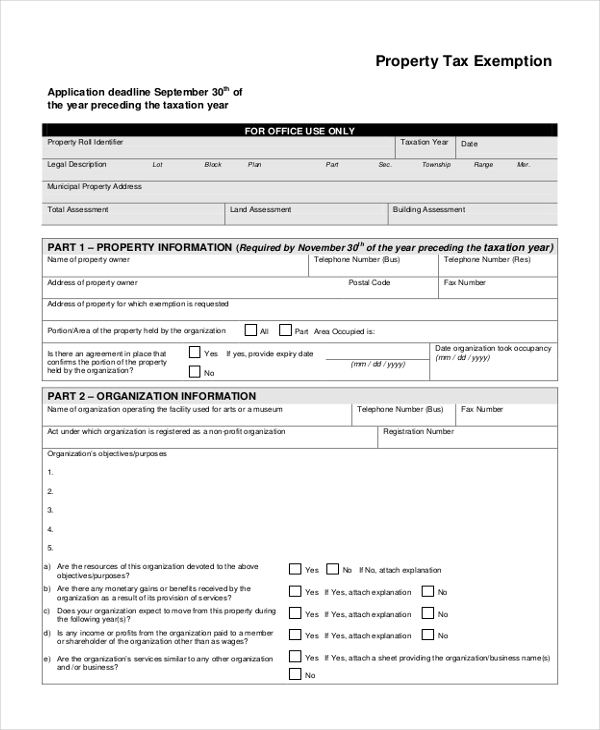

FREE 10 Sample Tax Exemption Forms In PDF

Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. The kentucky department of revenue. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax.

From mireiellewhenrie.pages.dev

Kentucky Farm Tax Exempt Form 2024 Evie Oralee Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. The kentucky department. Agriculture Tax Exempt Form Kentucky.

From www.dochub.com

Ky farm tax exempt number lookup Fill out & sign online DocHub Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. The kentucky department. Agriculture Tax Exempt Form Kentucky.

From www.exemptform.com

Kentucky Sales Tax Farm Exemption Form Fill Online Printable Agriculture Tax Exempt Form Kentucky Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. The kentucky department of revenue. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web you will need to have the agricultural sales tax exemption number and the farm. Agriculture Tax Exempt Form Kentucky.

From www.exemptform.com

Agriculture Tax Exempt Online Form Agriculture Tax Exempt Form Kentucky Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form.. Agriculture Tax Exempt Form Kentucky.

From www.pdffiller.com

Usda Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Agriculture Tax Exempt Form Kentucky Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. The kentucky department of revenue. Web the application for the agriculture exemption number, form 51a800, is available. Agriculture Tax Exempt Form Kentucky.

From www.formsbank.com

Fillable Agricultural Sales And Use Tax Certificate Of Exemption Agriculture Tax Exempt Form Kentucky The kentucky department of revenue. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web the application for the. Agriculture Tax Exempt Form Kentucky.

From www.formsbank.com

Sales And Use Tax Agricultural Exemption Certificate Form Sample Agriculture Tax Exempt Form Kentucky The kentucky department of revenue. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from. Agriculture Tax Exempt Form Kentucky.

From 51a260-form.pdffiller.com

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. The kentucky department of revenue. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web effective january 1, 2022,. Agriculture Tax Exempt Form Kentucky.

From mireiellewhenrie.pages.dev

Kentucky Farm Tax Exempt Form 2024 Evie Oralee Agriculture Tax Exempt Form Kentucky Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use. Agriculture Tax Exempt Form Kentucky.

From www.dochub.com

Ky tax exempt form pdf Fill out & sign online DocHub Agriculture Tax Exempt Form Kentucky Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. The kentucky department of revenue. Web you will need to have the agricultural sales tax exemption number and. Agriculture Tax Exempt Form Kentucky.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. The kentucky department of revenue. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to. Agriculture Tax Exempt Form Kentucky.

From www.signnow.com

Kentucky Farm Tax Exempt 20092024 Form Fill Out and Sign Printable Agriculture Tax Exempt Form Kentucky The kentucky department of revenue. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture. Agriculture Tax Exempt Form Kentucky.

From old.sermitsiaq.ag

Printable Tax Exempt Form Agriculture Tax Exempt Form Kentucky The kentucky department of revenue. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web the application for the agriculture exemption number, form 51a800, is available. Agriculture Tax Exempt Form Kentucky.

From www.exemptform.com

Wv Farm Tax Exemption Form Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. The kentucky department of revenue. Web you will need to have the agricultural sales tax exemption number and the farm. Agriculture Tax Exempt Form Kentucky.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Agriculture Tax Exempt Form Kentucky Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use. Agriculture Tax Exempt Form Kentucky.

From www.formsbank.com

Fillable Form St8f Agricultural Exemption Certificate printable pdf Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. Web you will. Agriculture Tax Exempt Form Kentucky.

From tax-exempt-form.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Agriculture Tax Exempt Form Kentucky Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. The kentucky department of revenue. Web effective january 1, 2022, krs 139.481 requires that farmers have an agriculture exemption number for use on forms 51a158 and 51a159 to make purchases. Web the application for the. Agriculture Tax Exempt Form Kentucky.

From www.uslegalforms.com

St125 2020 Fill and Sign Printable Template Online US Legal Forms Agriculture Tax Exempt Form Kentucky Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under. Web you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. Web a new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the farm exempt from sales tax. Web effective. Agriculture Tax Exempt Form Kentucky.